The Paradox of Change

It’s interesting that when a problem becomes so big that it forces you to act, it can at the same time cause you to accept the consequences as the new normal. Think of pollution, it took so many years for it to affect our climate that even though it’s forcing humanity to do something about it, we are accepting the consequences as the modern-day weather.

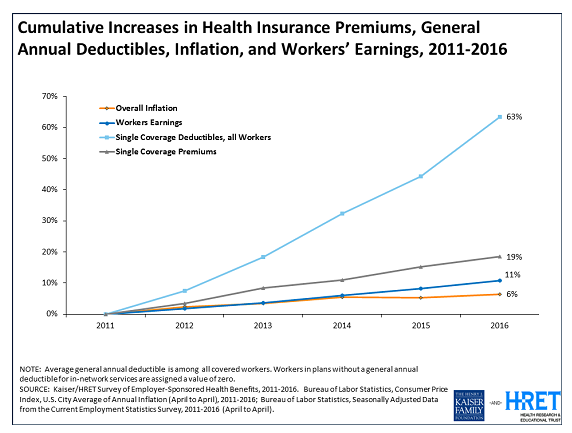

It seems healthcare and insurance have fallen into that same category. Everyone knows the costs of both healthcare and health insurance have risen faster than wages, even though as Americans we don’t live any longer or are any healthier.

Companies are fearful of their renewal every year but yet they simply accept it as the cost of doing business. To a certain point, I understand them, their focus is to grow and raise their profits, keep their employees happy and productive. They don’t have time to research and analyze other strategies especially when their broker or current provider sustain their own status-quo by not seeking a better option on their behalf.

One of a Growing Community

Recently I was meeting with a Doctor who had a better, more cost-effective way to help an employer with their healthcare through their Direct Primary Care offerings. He told me that when he shared it with a broker prior to our conversation, he was told: “There’s not enough money for us to advise on this to our clients, you couldn’t pay our salesman enough to help you promote this”.

Say what? Did he actually hear the words coming out of his mouth?

If you’re an Owner, CFO, HR or CEO imagine your employees said, “we can’t improve on our work but we are demanding a 10-30% increase in pay year after year” how would you react? That is what companies are allowing to happen when their healthcare vendors make more a higher dollar amount each year by increasing the volume of healthcare spending. Employers should be acutely aware when their sources of advice and actual vendors make more money as a proportion of overall healthcare cost increases. Afterall, is there any incentive for them to try and reduce my cost?

So What was that Cost Savings Solution?

My suggestion is to take the time to research or speak with a broker that is willing to explain to you the benefits of Value-Based Primary Care, and its most common arrangement, Direct Primary Care.

Take a look at what the research shows, a collective DPC group with practices in 43 states saw a whopping $119 million savings in decreased hospitalization. Another group recorded 35% less hospitalization use and 65% fewer ER visits, on top of that they noticed 82% fewer surgeries than other similar populations.

How is this possible you ask?

Think about the last time you saw a Doctor, you waited for about 30 to 45 minutes filling out a form in which you put down your symptoms. You then spoke with your doctor for about 10 to 15 minutes, he gave you a prescription and that was it. Oh, and you had to wait a couple weeks to schedule an appointment.

Because a doctor has to treat so many patients, they can’t spend enough time understanding each patient’s condition. They have to simply base their diagnosis on what symptoms they have, plus most medicine today suppresses the symptom instead of actually curing it.

With the DPC model doctors can properly diagnose patients and because they have a better relationship with them, they are also able to prevent sickness down the road or catch something earlier.

- But what if your employees travel a lot?

- What if they have an injury and need to the hospital?

- What about Chronic Care with a Specialist?

- Do employees have to leave their current doctors?

- What if my employees don’t want to change?

Yes, there are other questions that need to be addressed however if you don’t begin to change the way you evaluate healthcare and insurance you’ll simply be contributing to the problem or worse, accepting the consequences as the new normal.

I invite you to reach out to me or my office and begin a conversation that explores this option, don’t wait till open enrollment is near and please don’t wait until your broker brings this up.

I’ll Leave you with some Homework

Below is a link to a report that shows how the increase in quality of care reduces the overall cost of it. The subheading “Benefits of Direct Primary Care” will further help you see the impact it can have.

Let's Talk

Angel Saucedo

Consultant

About the author: Angel joined the AG team in 2016 after partnering with us on several projects for mutual clients over the course of the last decade. Now he brings his charisma, his big brain and his desire to make a positive impact to our collective team of industry leading consultants. Oh, and he is already a published author with the University of Texas Press before he ever picked up a pen for our humble AG Blog.

About AG Insurance: AG Insurance (www.agiainc.com) helps employers and their employees with solutions focused on positive organizational impact and improved employee experiences.