by Angel Saucedo | Aug 22, 2016 | Compliance, Dept of Labor, Employee Benefits, ERISA

In the ongoing list of complaints regarding the Affordable Care Act recently the DOL, IRS and PBGC released proposed changes to modernize and improve the existing 5500 form or annual return for employee benefit plans. This would essentially require all small groups...

by Mike Davis | May 3, 2016 | Compliance, Employee Benefits, Health Insurance, HSA, Plan Design, Plan Design

Do you wait with anticipation for each update from the IRS? Well, wait no more as Revenue Procedure 2016-28 was released last Friday. In Simple Terms, hardly anything changes for 2017 in regards to HSA’s next year. The only change is a small $50 increase on...

by admin | Sep 23, 2015 | ACA Reporting, Compliance, Data Analytics, Dept of Labor, Employee Benefits, Health Insurance, HSA, Plan Design

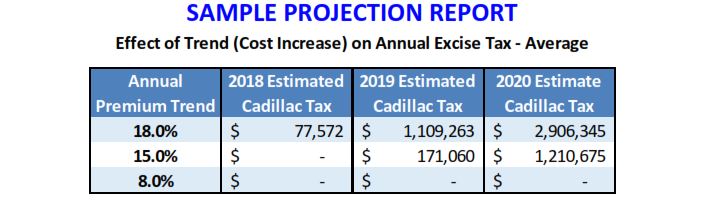

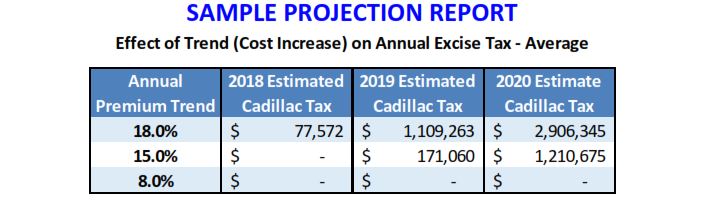

One of our brilliant clients recently put the Cadillac Tax into perspective: “So the Law could actually punish the employer with a 40% tax for doing what Healthcare Reform said they should do?” She was right, and here’s what you need to know. ...

by JC Cole | Sep 8, 2015 | ACA, ACA Reporting, Compliance, Dept of Labor, Employee Benefits, ERISA, Health Insurance, Labor Law

Here are some tips to help employers develop a compliance strategy and be made aware of upcoming requirements for employee group health plans for the upcoming 2016 year. Plan Design Changes If changes were made to grandfathered plans, they may go beyond permitted...