by Stacy Barrow | Nov 7, 2017 | ACA, ACA Reporting, Compliance, Employee Benefits, Health Insurance

IRS Updates Employer Mandate FAQs: Indicates that Penalty Letters are Imminent The Internal Revenue Service (IRS) has updated its list of frequently asked questions (FAQs) on the Affordable Care Act’s employer shared responsibility provisions – also known as the “pay...

by JC Cole | Aug 26, 2016 | ACA, ACA Reporting, Compliance, Employee Benefits, Health Insurance

Bad habits are easy to form (1095c). When the authorities that be (in this case the IRS) give us extensions or delay their own rules, we fall prey to our own human nature. We form bad habits before we ever get a chance to form a good habit. This is the case with the...

by admin | Sep 23, 2015 | ACA Reporting, Compliance, Data Analytics, Dept of Labor, Employee Benefits, Health Insurance, HSA, Plan Design

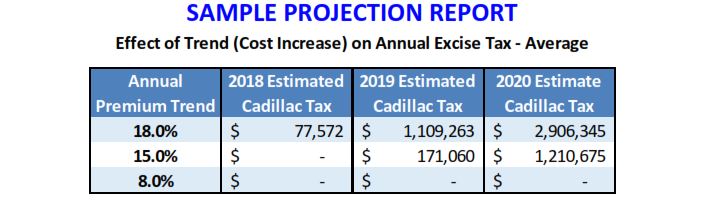

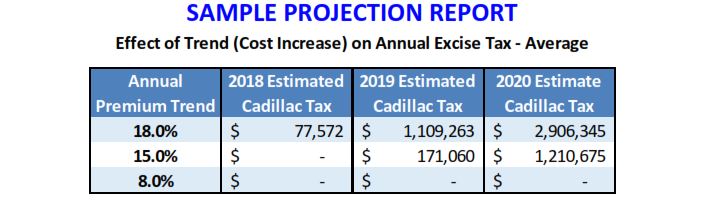

One of our brilliant clients recently put the Cadillac Tax into perspective: “So the Law could actually punish the employer with a 40% tax for doing what Healthcare Reform said they should do?” She was right, and here’s what you need to know. ...

by JC Cole | Sep 8, 2015 | ACA, ACA Reporting, Compliance, Dept of Labor, Employee Benefits, ERISA, Health Insurance, Labor Law

Here are some tips to help employers develop a compliance strategy and be made aware of upcoming requirements for employee group health plans for the upcoming 2016 year. Plan Design Changes If changes were made to grandfathered plans, they may go beyond permitted...