One of our brilliant clients recently put the Cadillac Tax into perspective:

“So the Law could actually punish the employer with a 40% tax for doing what Healthcare Reform said they should do?“

She was right, and here’s what you need to know.

What is Cadillac Tax?

A tax on high-cost group health coverage. Also known as High-cost Plan Tax (HCPT)

Cost set at $10,200 for Individual Coverage or $27,500 for Family Coverage in 2018

Why does it exist?

The Affordable Care Act (ACA) imposes this tax to encourage companies to choose lower-cost health plans for their employees.

When will it begin?

First taxable for the year 2018.

(Many Employers are implementing a trend to lower cost/higher deductible plans now so that there isn’t a “Shock” change at Open Enrollment in 2017).

How does it work?

It taxes plans at 40% of each employee’s health benefits that exceed certain cost thresholds

Specifically, it taxes the amount by which the monthly cost of an employee’s applicable employer-sponsored health coverage exceeds the annual limitation (employee’s excess benefit).

Tax amount for each employee’s coverage will be calculated by the employer and paid by the coverage provider who provided the coverage.

Who does Cadillac Tax apply to?

According to the most recent studies by the Kaiser Family Foundation–1 in 4 Employers will be affected.

Applicable Employer-Sponsored Coverage: coverage under any group health plan made available to the employee by the employer, which is excludable from the employee’s gross income under Code Section 106.

Governmental plans and Self-employed individual group health plans will both be treated as applicable employer-sponsored coverage and subject to Cadillac Tax

Cadillac Tax does not apply to:

Coverage for long-term care and any coverage that is considered an “excepted benefit,” other than coverage for on-site medical clinics

“Excepted Benefits” include:

accident-only or disability income insurance,

supplemental liability insurance

general and automobile liability insurance

workers’ compensation

automobile medical payment insurance

credit-only insurance

other similar insurance in which medical care benefits are secondary or incidental to other insurance benefits

Dental and Vision plans that constitute “excepted benefits” are not subject to Cadillac plan tax.

Who pays for Cadillac Tax?

Responsible paying party is the “coverage provider.” Could be insurer, employer, or third-party administrator:

| If Coverage Is: | The Coverage Provider Is: |

| Health Insurance Coverage | The health insurance issuer–with cost passed back to Employer |

| HSA or Archer MSA Contributions | The Employer |

| Other coverage |

The person that administers the plan benefits (This includes the plan sponsor, if the plan sponsor administers benefits under the plan. However, no other guidance has been issued to better define this term.) |

2018 seems so far away. Why should we address Cadillac Tax now?

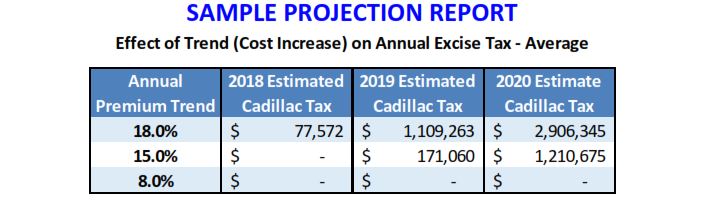

Kaiser Family Foundation projections show the number of employers affected by Cadillac tax will only grow increasingly in the coming years

By making changes now, employers can phase-in changes to avoid a bigger disruption down the road and this will set the stage for employees to pay for a greater share of their healthcare out-of-pocket.

Ways for employers to reduce costs under the tax:

Increase deductibles and cost sharing

Eliminate the option of higher-cost health insurance

Use narrower, less-expensive provider networks

Offer benefits through a private exchange

Eliminating or capping Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

For further education on Cadillac Tax and how it can affect you as an employee or employer, please check out the links below:

Cadillac Tax on High cost Health Coverage

IRS Invites Comments on Cadillac Tax Implementation for 2018